Dear Shareholders,

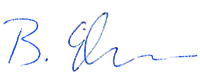

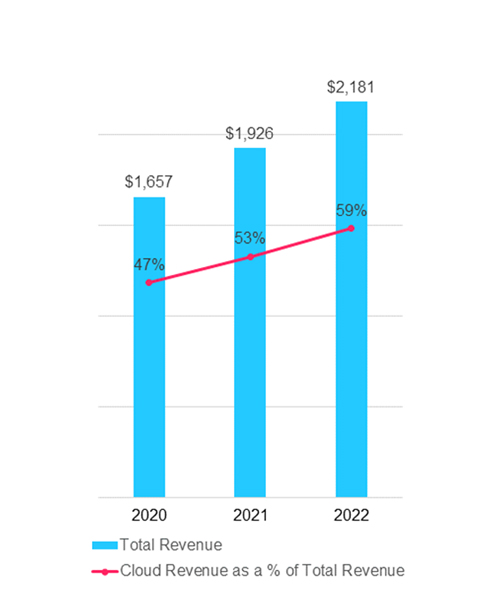

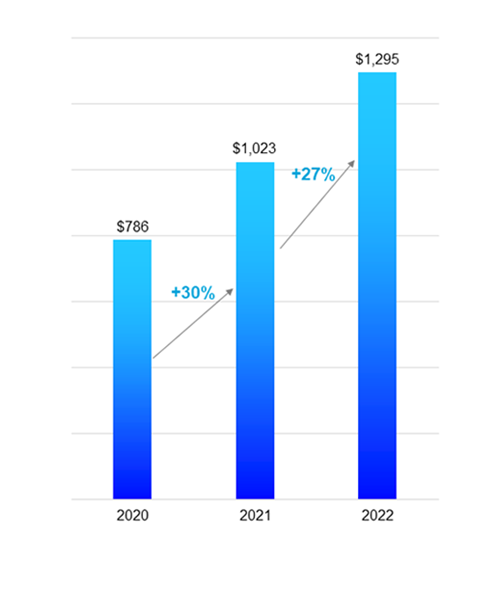

Nine years ago, we embarked on an exciting journey to turn NICE into a company that is built to transform. With a clear long-term strategy and coordinated execution, we went through multiple transformations, growing and cementing our leadership in the markets in which we operate. 2022 was another pivotal year for NICE, a year in which we surpassed significant milestones buttressed by our continued strong top and bottom-line growth. These milestones included crossing two billion dollars in total revenue while continuing to move swiftly towards a 30 percent plus operating margin, as well as having the best year ever for new customer acquisition and new partner onboarding. Moreover, we now have 60 percent of our total revenue in the cloud, growing at the fastest pace and scale of any company in our industry, accomplishing our mission of transforming NICE into a market-leading enterprise cloud company. These 2022 achievements have created the perfect stepping-stone for our next transformation.

Growing up as a child in the 1980s, I remember the feeling inflicted by the occasional power outage. Having no electricity to power up the TV, stereo or video games felt like being deprived of something essential. Looking at my own children growing up today, they exhibit the same reaction when they temporarily lose Wi-Fi reception, and recoil in shock and amazement when they hear tales about an ancient time before the age of constant connectivity. I believe that for my grandchildren, living 15 years from now, the same will hold true for Artificial Intelligence. It will be hard for them to fathom how humanity could have possibly survived without AI fully embedded, uninterrupted, within our daily lives.

Artificial Intelligence is waiting in unsuspicious serenity to pounce on us as the next disruptive technology, and it is poised to transform the fundamentals of the enterprise software market. Anticipating this massive AI swell, we have been investing in both organic innovation and strategic acquisitions over the last few years to actively transform our cloud platforms into AI platforms and transform NICE into an AI company.

AI is the most prominent force reshaping the nature of digital transformation and redefining the premise of its value proposition. In fact, it is no longer possible to view AI and digitalization as separate forces. Rather, they are intertwined entities that are forming a powerful new symbiotic relationship. This realization is defining the next step in our journey as we use the power of AI to reshape our markets. With purpose-built AI, we will transform Customer Experience, empowering organizations to anticipate customer needs and create unattended, brilliant, human-like service. For Financial Crime and Compliance, the power of AI will accurately identify risk events along the entire customer lifecycle, stopping threats and fraudulent activities before they occur. And, our advanced AI capabilities will create a swift and fair digitalized Criminal Justice system.

The internet, the emergence of mobile and the shift to the cloud were all technology waves that left an indelible impact on many aspects of our lives and completely changed the landscape for enterprises. AI is the next tidal wave and will become critical to the success of companies today more than any previous technology revolution. Enterprises cannot afford to skip this technology wave or even take their time adopting AI, as it is the only way for them to overcome two fundamental challenges currently facing businesses: the ability to efficiently manage complexity at scale and the ability to mitigate the shortage of skilled labor. We believe that only companies who will combine strong digital capabilities with robust adoption of a proactive AI strategy will be able to achieve success and see outsized financial performance.

The same holds true for enterprise software vendors. Those who are able to evolve from

a software company to an AI company will realize the greatest benefits and become the most valuable, as public investments, private capital and corporates will shift and prioritize AI use cases and applications over other opportunities.

NICE is already well on its way to becoming a leading AI company across its markets. Our rapidly developing AI capabilities are setting us distinctly apart from our competition and building an unbridgeable gap of differentiation. We have already demonstrated our clear leadership as a cloud platform company, and we are now making significant strides to widen our lead as we expand into AI and digital. The strength of our AI solutions rests in the unique assets that we own: a cloud platform that has been widely adopted, massive amounts of historical data, and industry-specific domain expertise.

Becoming an AI company is significantly expanding our total addressable market. Moving forward, we expect to generate an increasing amount of revenue from our platforms, as we expand from monetizing on the number of users to the exponentially growing number of transactions and interactions managed by our AI platforms. As our TAM continues to expand, we believe it will drive a long runway for both growth and increasing profitability.

Another characteristic of our leadership and our competitive strength is our unique, industry-leading financial profile, especially as it pertains to our superior profitability, strong annual cash flow from operations and sizeable cash position. Our financial strength gives us the ability to further invest in growth through research and development, as well as through acquisitions, to capture additional market opportunities in 2023 and in the years to come.

But our leadership goes well beyond technology and innovation in our various markets. Along with our 8,500 employees, NICE is dedicated to creating a positive impact as our NICErs are deeply involved in various volunteering activities within their local communities. I have always held that it is imperative for CEOs to use their voice publicly and I intend to continue doing so at opportune moments of profound impact, promoting those values I care for with a passion: freedom, human rights and the uncompromising criticality of preserving democracy.

This is my 10th year as the CEO of NICE, and along with an exceptional team of the most professional and committed executives I’ve ever had the privilege of working with, we have more than doubled our revenues, tripled our profitability, and built scale and leadership that delivered outstanding shareholders returns.

I speak on behalf of the entire NICE team when I say that as we look towards the future, our level of passion and enthusiasm about the opportunity ahead is stronger than it has ever been before.

The strength and success of NICE is built on the dedication and support of our employees around the world. We attract the most talented employees and have assembled the best team in our industry. For our customers, we are creating value by unlocking the power of technology to help them grow their businesses. We are committed to our growing network of partners, who help us deliver our market leading solutions to our customers around the world. And, we thank our shareholders for their continued trust, confidence and motivation to be part of our journey.

Sincerely,

Barak Eilam

Chief Executive Officer